straight life annuity settlement option

Live at least to his life expectancy. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Settlement Options E Commerce Lecture Slides Slides Fundamentals Of E Commerce Docsity

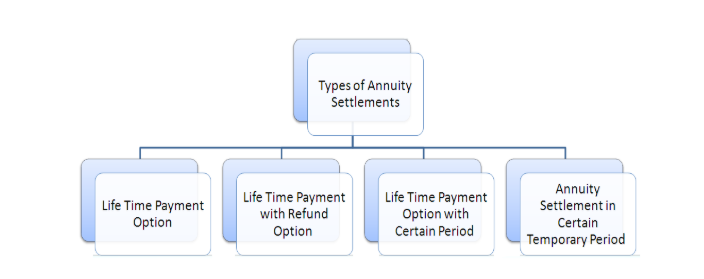

Because of the wide variance in annuities choosing a pure life annuity settlement option modifies how the principal of the account is distributed after the policyholder dies.

. Under a pure life annuity an income is. If an annuitant selects the straight life annuity settlement option in. The husband dies and his wife continues to receive.

The straight life annuity option provides the largest amount of guaranteed for life income of any retirement plan choice. They may also be named according to the settlement option attached to the. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

Under a straight life annuity if the annuitant dies before the principal amount is paid out the beneficiary will receive. On the non-distributed portion allowing more time for potential tax-deferred growth of annuity assets. Also known as a straight-life or life-only annuity a single.

Study with Quizlet and memorize flashcards containing terms like A married couples retirement annuity pays them 250 per month. Study with Quizlet and memorize flashcards containing terms like Your client is planning to retire. Provides a reduced monthly benefit for the first 10 years of payments.

After 120 payments your benefit is automatically adjusted to your Straight Life. You may hear them called life annuities lifetime payout annuities or straight life annuities. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

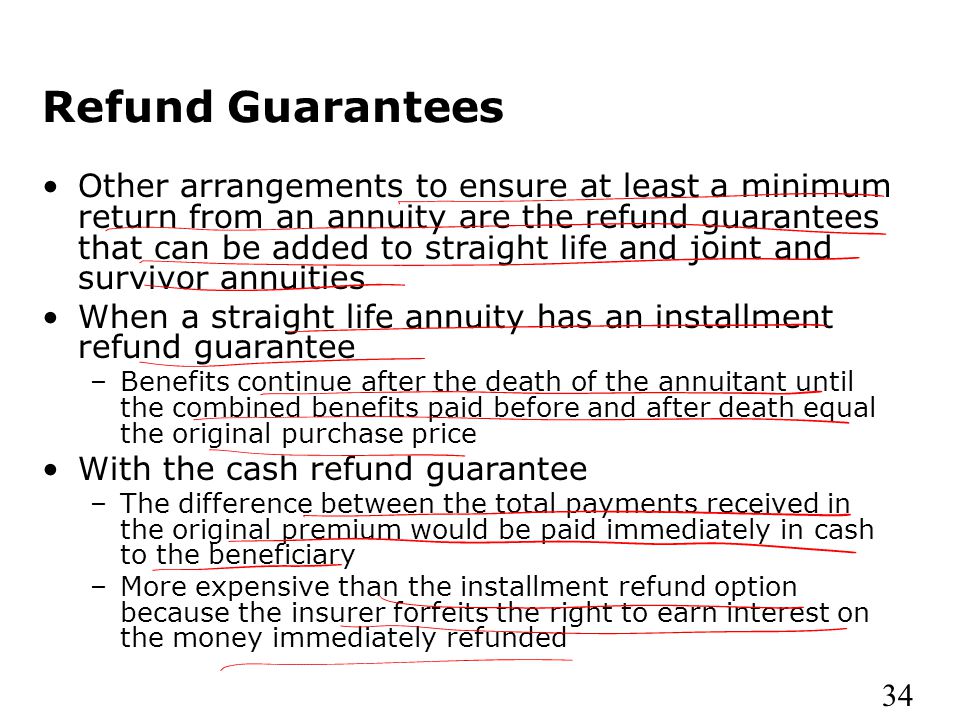

Straight life annuities do. Refund straight life is one of the annuity settlement options where your beneficiary gets the proceeds and the interest earned in the event that you die. Refund Straight Life.

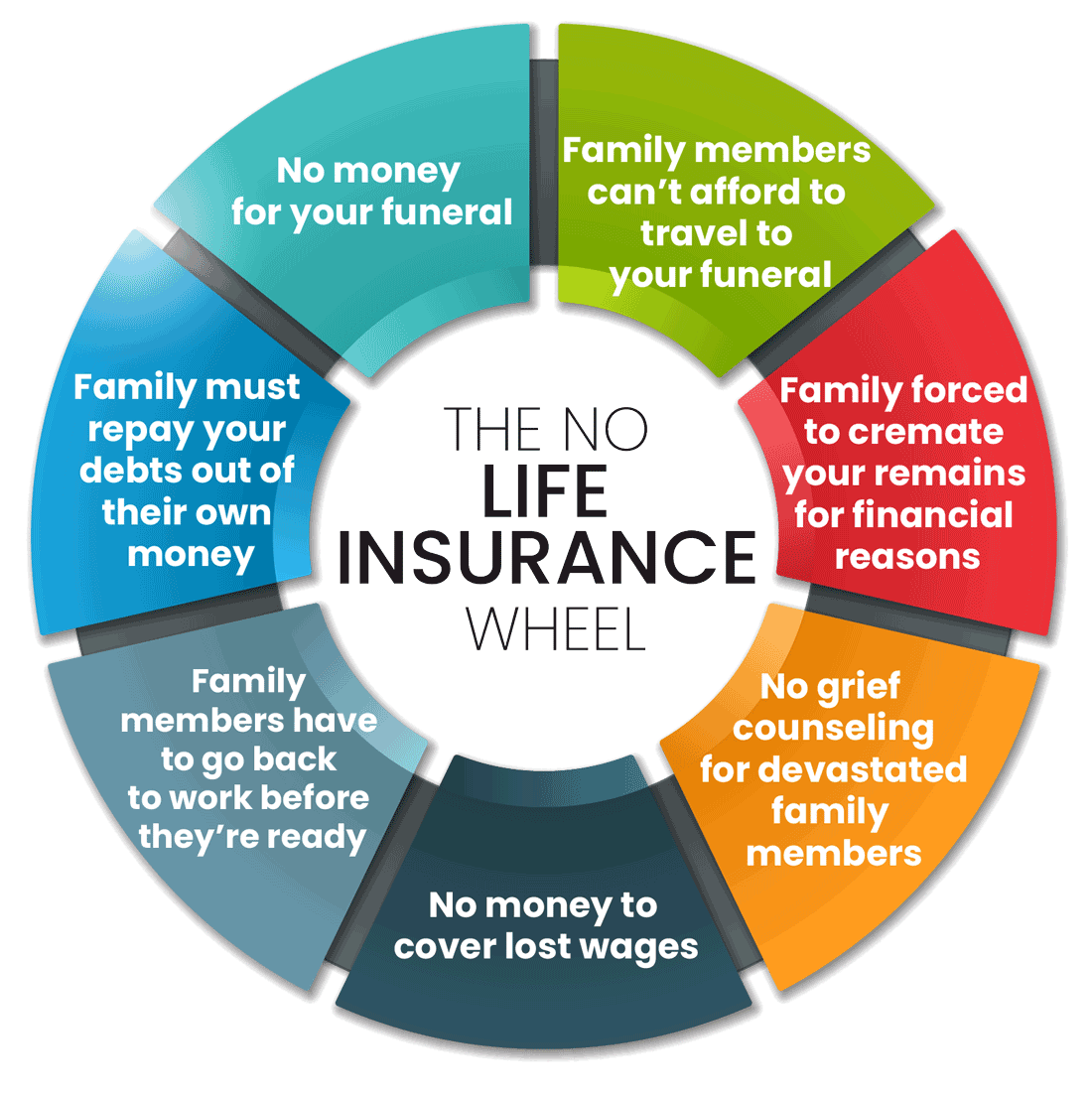

Settlement Options for Life Insurance - A settlement option may also be elected on life. If an annuitant selects straight life annuity settlement option in order to receive all of the money the owner needs to. Pure or straight life annuity settlement option will only pay for as long as the annuitant lives.

However if heshe dies after receiving the first payment no more payments would be made to. She has accumulated 100000 in a retirement annuity and now wants to select the benefit. The annuity settlement option can automatically transfer the proceeds of an insurance contract or policyincluding a guaranteed interest account GIA segregated fund.

Life Income Joint And Survivor Settlement Option Guarantees Quickquote

Annuities And Individual Retirement Accounts Ppt Video Online Download

The Pros And Cons Of Joint Life Annuities Trusted Choice

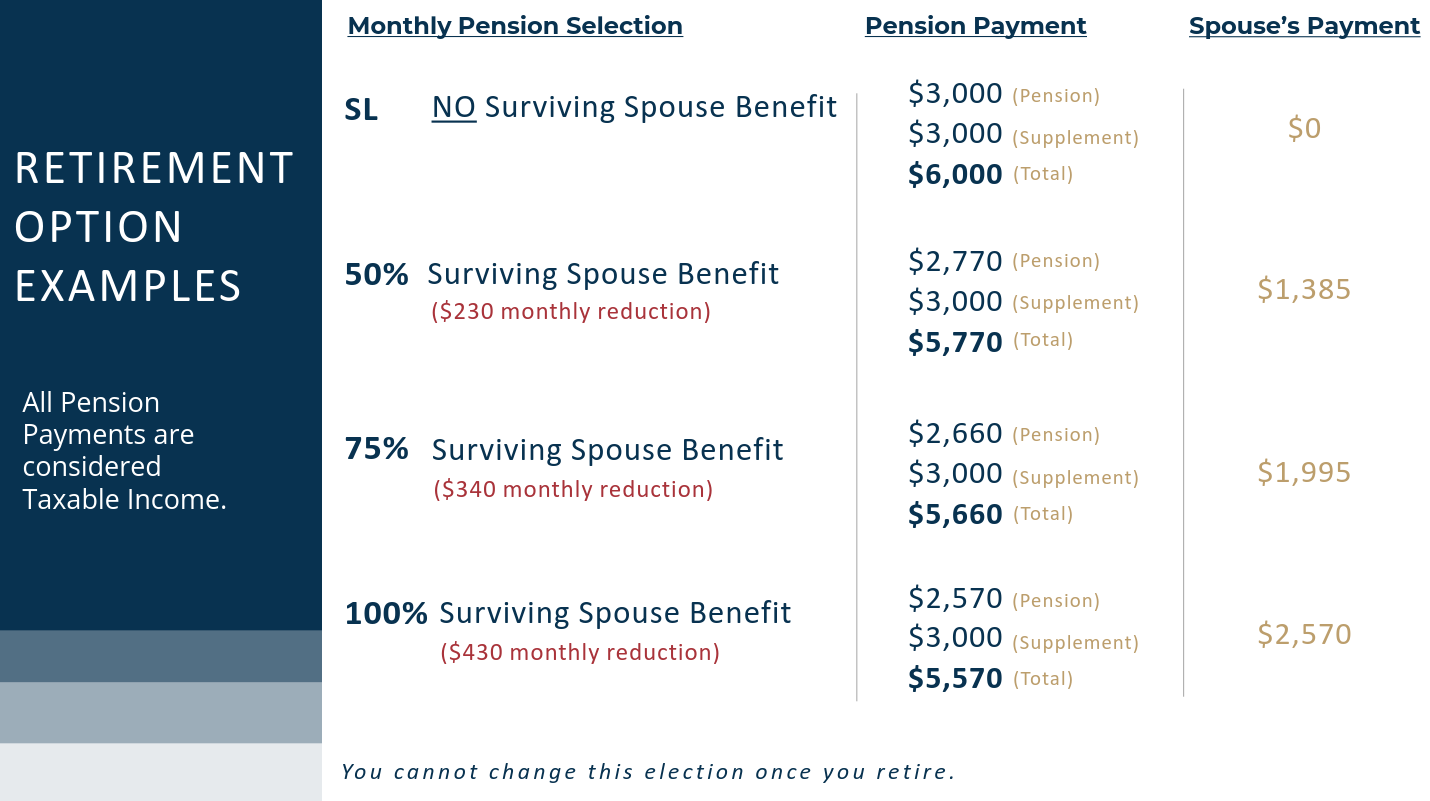

Types Of Monthly Retirement Options Carpenters Benefit Funds Of Philadelphia

Period Certain Annuity What It Is Benefits And Drawbacks

Learn The Basics Of Pure Life Annuities Trusted Choice

You Re Getting A Pension What Are Your Payment Options Beyond The Numbers U S Bureau Of Labor Statistics

Annuity Payout Options Immediate Vs Deferred Annuities

Flight To Safety Propels New York Life Others To Top Of Annuity Hill Insurancenewsnet

Annuities And Individual Retirement Accounts Ppt Video Online Download

Retirement Guide For Conocophillips Employees The Retirement Group

Annuity Beneficiaries Inherited Annuities Death

:max_bytes(150000):strip_icc()/Term-a-annuity_Final-22818c662b274f2c82716dd2184f06c9.png)

Guide To Annuities What They Are Types And How They Work

Learn The Basics Of Pure Life Annuities Trusted Choice

What Is A Straight Life Annuity Everything You Need To Know

11 Annuity And Tax Questions Answered Thinkadvisor

What Is A Straight Life Annuity Everything You Need To Know

Structured Settlements Don T Be Fooled By A Catchy Tv Jingle Prudential